option to tax form

The main reason a supplier would choose an option to tax is to recover VAT on associated costs. Complete Edit or Print Tax Forms Instantly.

Ez Checks Alternative In 2021 Business Tax Check Email Online Checks

This means changing an exempt supply which you wont be able to recover VAT on into a taxable supply so VAT can be gained.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The advanced tools of the editor will guide you through the editable PDF template. However the complete worksheet or equivalent.

Click on Employer and Information Returns and well mail you the forms you request and their instructions as well as any publications you may order. The updated Federal Basis Limitation Worksheet has been shortened and is no longer an acceptable version of the Basis Limitation Worksheet. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes.

Save this form with your investment records. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment Form 4768 Application for Extension of Time to File a Return andor Pay US. Options contracts on equities that can be traded on the open market.

This notice has been updated to provide information on who is an authorised signatory for the purposes of notifying an option to tax the details can be found in a new paragraph 76. 15 May 2020 Form Certificate to disapply the option to tax buildings. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and.

The IRS and all other applicable copies of the form visit wwwIRSgovorderforms. Option to FORCE IRS Form 7203. Certificate to disapply the option to.

Form Revoke an option to tax for VAT purposes within the first 6 months. Once ready users can transmit their prepared tax forms electronically to the IRS and respective state or print and mail a copy of their filing. Order by phone at 1-800-TAX-FORM 1-800-829.

This form will report important. IRS Direct Pay is a secure service you can use to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you. Get the current filing years forms instructions and publications for free from the Internal Revenue Service IRS.

Call HMRC for help on opting to tax land or buildings for VAT purposes. The vast majority of businesses dont need or choose to tax their trading premises. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re.

Ad Our software walks you through the process to quickly file your tax return. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. Income Tax Return For US.

Should I opt to tax. The stock trades at 22 upon expiry and the investor exercises the option. Form 2350 Application for Extension of Time to File US.

Get Tax Forms and Publications. These are generally options contracts given to employees as a form of compensation. Until you sell the unites you dont have to enter information from Form 3921 into your tax return.

The cost basis for the entire purchase is 2100. VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. Information about Form 3921 Exercise of an Incentive Stock Option Under Section 422b including recent updates related forms and instructions on how to file.

Sign Online button or tick the preview image of the form. Form 3922 is issued for employee stock options that you purchased but do not sell. Download them from IRSgov.

Estate and Generation-Skipping Transfer Taxes. Use this form only to notify your decision to opt to tax land andor buildings. VAT1614C - revoking an option to tax within 6 month cooling off period Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

For example puts. To get started on the form use the Fill camp. All major tax situations are supported.

File Electronically or Print Mail. Lets say it. Get Federal Tax Forms.

If you file your taxes by paper youll need copies of some forms instructions and worksheets. Ad Access IRS Tax Forms. Unfortunately this IRS Form 7203 is not required for all S-corps.

Since you have not sold the stock the holding period requirements have not been determined. When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b.

I assume Lacerte did this because of the new IRS Form 7203. Corporations file this form for each transfer of stock to any person pursuant to that persons exercise of an incentive stock option described in section 422b. Form for Notification of an option to tax Opting to tax land and buildings on the web.

Information returns may also be filed electronically using the IRS Filing Information Returns. Thats 20 x 100 shares plus the 100 premium or 2100. For tax purposes options can be classified into three main categories.

Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. Complete the five easy steps and youll receive instant confirmation after you submit your payment. Ad File Your 1040ez Tax Form for Free.

The timing of submission is important.

Paper Filing Top Documents That Must Be Attached To Your Tax Return Forms Taxreturnforms Tax Return Tax Services Tax

Installment Payment Agreement Contract Template Payment Agreement Payment Plan

Executive Summary Executive Summary Template Executive Summary Executive Summary Example

Example Rental Deposit Form Acceptance Letter Business Template Deposit

Sample Termination Letter For Cause Check More At Https Nationalgriefawarenessday Com 24673 Sample Termination Letter For Cause

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Filing Taxes Singapore

Invoice Template Word Logo Billing Form Editable Etsy In 2022 Invoice Template Invoice Template Word Words

Free Execution Of Release If Option Not Exercised Form Real Estate Forms Reference Letter Word Template

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

Pin By Tarah Rasey On Pta Donation Letter Pto Fundraiser Fundraising Letter

Form 1040 U S Individual Income Tax Return 2015 In 2022 Income Tax Return Tax Return Income Tax

Form Analisis Butir Soal Pilihan Ganda Dan Isian Pengetahuan Wallpaper Ponsel

Job Application Form Template Word Best Of Generic Job Application 8 Free Word Pdf Documents

Tax Due Dates Stock Exchange Due Date Income Tax

Payment Arrangement Letter Template Beautiful Promise To Pay Agreement

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Tax Refund Income Tax Return Tax Return Tax

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Job Application Template Form Example Tax Forms

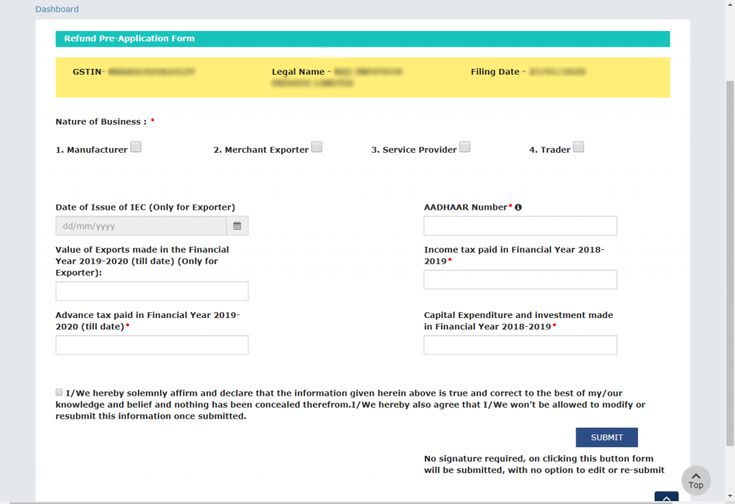

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes